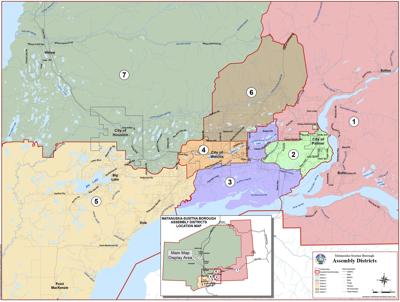

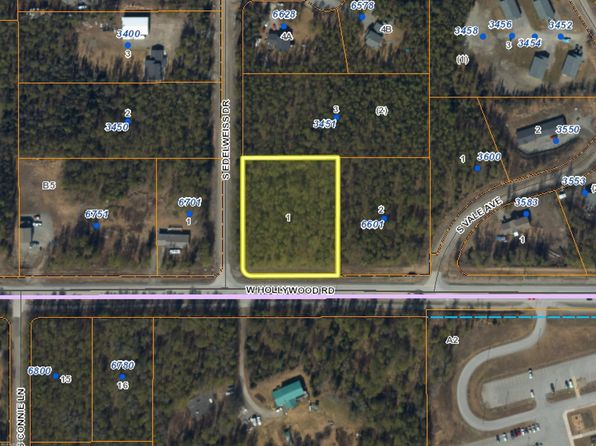

Mat Su Borough Property Tax Payment

A tax rate applied to your property s assessed value determines the amount of tax you pay.

Mat su borough property tax payment. To pay online use point pay. Matanuska susitna borough collects on average 1 15 of a property s assessed fair market value as property tax. To ensure your payment is credited accordingly include the fee payment name in the memo field as well as property identifier. Please pay all other planning department fees by check or money order and mail to matanuska susitna borough 350 e dahlia ave palmer ak 99645.

The tax rate is determined by the borough assembly. For taxes paid online a 3 convenience fee is added by the processor. Property tax exemption for senior citizens disabled veterans. You will need a credit card and your tax bill.

Mat su voters recently adopted an additional property tax exemption for senior citizens disabled veterans. Aircraft registration ambulance fees animal care donations animal care fees bed tax business inventory tax business license fire code fees ice arena fees landfill local improvement district miscellaneous park fees planning fees pools real property tax talkeetna sewer and water tobacco tax. Matanuska susitna borough has one of the highest median property taxes in the united states and is ranked 292nd of the 3143 counties in order of median property taxes. The assessor s primary responsibility is to find the full and true value fair market value of your property so that you may pay only your fair share of the tax burden.