Mat Su Borough Property Assessment

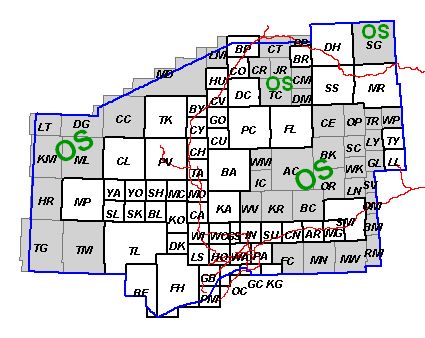

Account id owners address subdivision map pdf dxf.

Mat su borough property assessment. Welcome to the matanuska susitna borough tax map download page. Taxmaps are available in pdf and dxf formats. For more information regarding the assessment value of your property real property ownership or address records real property tax exemptions or other assessing department functions please visit the assessing department s page or contact them at 907 459 1428. To mail in a check send it to.

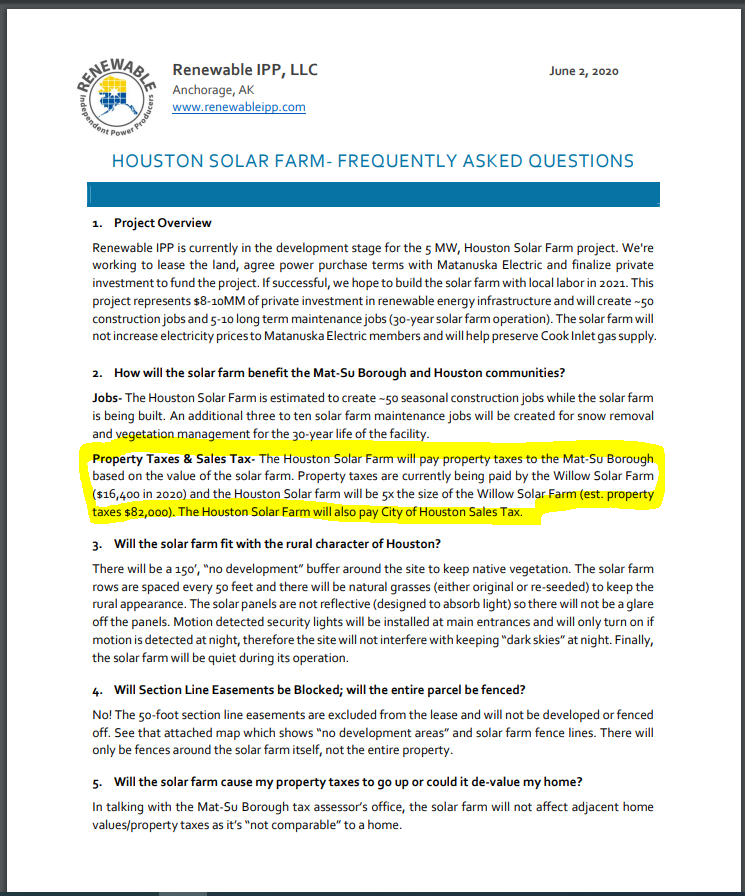

You can help by providing them with up to date and accurate information. Tax bills were mailed out by july 1 as required by state law. The division is responsible for maintaining accurate ownership records and value conclusions on over 77 000 properties within the borough. To pay online use point pay.

2451 s green jade pl. Taxes are billed in july and due in two parts in august and february of the following year. The tax assessor s office can also provide property tax history or property tax records for a property. You can find these maps two different ways.

The borough database lists the last name first so if you want to search for bill jones enter. Please call the main borough number at 907 861 7879 and ask for assessments. The assessment division also administers state mandated exemptions and borough optional exemptions. The pdf formats can be easily viewed by most users.

Use the search of tax maps box. Thanks to the international association of assessing officers for their permission to adapt copyrighted material for use by. Go to www matsugov us ecommerce and look for the real property tax icon. Dahlia ave palmer ak 99654.

The 2020 regular election is november 3 and all the candidates are now final. Davis stanley howard harrison davis morna l. There is an assessment appeals period in the beginning of the year. The assessor s office relies on the property owner for information.

The dxf format is intended for use in mapping programs such as autocad and arcmap. Click on link and scroll down to the bottom. The matanuska susitna borough tax assessor is responsible for assessing the fair market value of properties within matanuska susitna borough and determining the property tax rate that will apply. You will need a credit card and your tax bill.

Assessment is a state mandated function performed by the borough.